ETH Price Prediction: Path to $5,000 Supported by Technical Strength and Institutional Momentum

#ETH

- Technical Strength: ETH trading above 20-day moving average with Bollinger Band support indicating bullish momentum

- Institutional Adoption: Grayscale's staking preparations and whale accumulation signaling strong institutional demand

- Network Development: Fusaka upgrade acceleration and shrinking supply creating positive fundamental backdrop

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

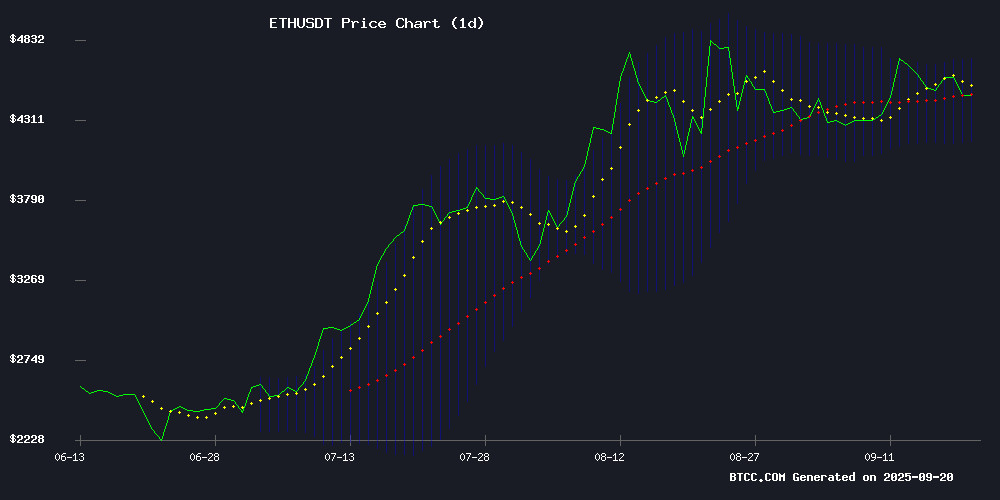

ETH is currently trading at $4,467.52, positioned above its 20-day moving average of $4,441.15, indicating underlying strength. The MACD reading of -74.30 suggests some bearish momentum, but the price holding above the moving average shows resilience. Bollinger Bands indicate support at $4,171.00 and resistance at $4,711.29, with the current price sitting comfortably in the upper half of the range.

According to BTCC financial analyst John, 'The technical setup suggests ETH is building momentum for a potential breakout. Holding above the 20-day MA is crucial for maintaining bullish sentiment.'

Market Sentiment: Institutional Demand and Upgrades Fuel ETH Optimism

Recent developments including Grayscale's preparation to stake ethereum holdings and the accelerated Fusaka upgrade scheduled for December 2025 are creating positive market sentiment. Whale accumulation of $76 million in ETH and shrinking supply due to institutional demand are additional bullish factors.

BTCC financial analyst John notes, 'The combination of institutional adoption through Grayscale and the upcoming network upgrades provides fundamental support for ETH's price appreciation. The $5,000 target appears increasingly plausible given these developments.'

Factors Influencing ETH's Price

Ethereum Eyes $5,000 Milestone Amid Onchain Strength and Institutional Demand

Ethereum trades NEAR $4,471 despite a 1.14% dip, maintaining a $539.7 billion market cap. Onchain metrics and corporate treasury movements signal potential for a breakout toward $5,000.

Validator exits have surged, with 2.45 million ETH ($11 billion) awaiting unstaking—a 42-day queue that may temporarily pressure supply. Yet institutional rebalancing often absorbs such flows without immediate selling pressure.

Network fundamentals strengthen as transaction fees jump 35% weekly and active addresses rise 10%. The activity boost enhances validator yields while fee burns tighten supply. Corporate treasuries added 877,800 ETH ($4 billion) last month, with firms like Bitming Immersion Tech and SharpLink Gaming treating ETH as a reserve asset.

Ethereum To Launch Fusaka Upgrade on Dec 3

The ethereum network is set to undergo its highly anticipated Fusaka upgrade on December 3, as confirmed by core developers. This milestone has generated significant excitement within the crypto community, marking a pivotal moment for the blockchain's evolution.

The upgrade, which has been in development for months, is expected to bring notable improvements to the network. While specific technical details remain undisclosed, the announcement has already sparked renewed interest in Ethereum's ecosystem.

Ethereum Price Analysis: Key Levels to Watch as ETH Nears Decision Point

Ethereum's price action has entered a critical phase after a month-long consolidation below the psychologically important $5,000 level. The second-largest cryptocurrency by market capitalization continues to trade within a well-defined ascending channel that has contained its impressive rally since April.

Technical indicators suggest an imminent breakout or breakdown. The daily chart shows ETH comfortably above key moving averages, with the 100-day and 200-day MA providing strong support at $3,700 and $2,900 respectively. Market participants are closely watching the $4,800 resistance level—a decisive break above this threshold could trigger a rapid ascent toward $5,000.

Shorter-term analysis reveals a tightening range between $4,300 support and $4,800 resistance on the 4-hour chart. The converging trendlines of the ascending channel indicate volatility may increase substantially in coming sessions. Traders should prepare for potential tests of either the $4,000 support zone or new all-time highs above $5,000.

Ethereum Whales Score $76M, Fuel Speculation on ETH Price

Large-scale Ethereum investors have made a significant $76 million purchase, sparking market speculation about a potential price rally. The move comes amid broader market declines, raising questions about whale accumulation strategies during downturns.

Traders are closely monitoring the unusual buying activity, which contrasts with typical retail investor behavior during bearish phases. The substantial investment suggests institutional confidence in Ethereum's long-term value proposition despite short-term volatility.

Ethereum Accelerates Fusaka Upgrade to December 2025, Developers Confirm Smooth Progress

Ethereum's Core developers have fast-tracked the Fusaka upgrade, now slated for mainnet activation on December 3, 2025—a full year ahead of initial projections. The timeline was cemented during the All Core Developers Consensus call, where teams also finalized testnet schedules and parameters for the accompanying blob-parameter-only hard fork.

Despite minor instability in Devnet-5 this week—which temporarily hampered data collection on blob configurations—the overall rollout remains on track. Stable performance of Devnet-3 and partial metrics from Devnet-5 have already yielded actionable insights for optimizing transaction blob limits.

Christine Kim, a prominent Ethereum researcher, notes the unusual consensus among developers signals strong alignment. "Barring catastrophic test failures in coming months," she observes, "this could be one of Ethereum's most seamless upgrades to date." The Fusaka enhancement aims to further streamline Ethereum's post-Merge infrastructure.

Ethereum Whales Accumulate as Supply Shrinks Amid Grayscale Staking Speculation

Ethereum's circulating supply is tightening as large investors aggressively accumulate ETH, with holdings in accumulation addresses doubling from 13 million to 28 million tokens since June 2025. This rapid depletion of available supply could amplify price volatility in coming months.

Grayscale Investments has moved 40,000 ETH in recent transactions, signaling potential plans to stake portions of its 1.5 million ETH holdings. Such a move WOULD mark the first participation in network validation by a U.S.-listed Ethereum ETF, potentially reshaping institutional engagement with proof-of-stake blockchains.

CFTC Taps Crypto Experts as Advisors, Key Seats Still Vacant

The Commodity Futures Trading Commission (CFTC) is bolstering its digital asset expertise with new appointments to its Digital Asset Markets Subcommittee (DAMS). Industry leaders from Uniswap Labs, Aptos Labs, BNY Mellon, and chainlink Labs will advise on regulatory frameworks and market policy. The move underscores the agency's push to keep pace with rapid innovation in crypto markets.

JPMorgan's Scott Lucas and Franklin Templeton's Sandy Kaul will co-chair the committee, bridging traditional finance and decentralized systems. Their mandate includes addressing risk management and policy clarity for digital assets. Lucas emphasized collaboration with industry partners to develop balanced regulations, while Kaul highlighted the dual priorities of fostering innovation and investor protection.

Acting CFTC Chair Caroline Pham praised the advisory group's contributions, noting its influence on both domestic policy and global conversations about digital asset regulation. The appointments come as the CFTC operates with multiple commissioner vacancies, leaving Pham as the sole active commissioner overseeing these critical market structure discussions.

Grayscale Prepares to Stake Ethereum Holdings, Signaling Institutional Adoption

Grayscale Investments is reportedly preparing to stake a portion of its substantial Ethereum holdings, marking a pivotal moment for institutional participation in crypto. On-chain data reveals a transfer of over 40,000 ETH, consistent with staking preparations. The firm manages approximately 1.5 million ETH across its trusts.

This MOVE would make Grayscale the first U.S.-based ETH ETF sponsor to offer staking—a feature previously contested by the SEC. Analysts view this as a potential catalyst for broader institutional adoption, with staking rewards incentivizing long-term network engagement.

The development follows growing demand for yield-generating crypto strategies among asset managers. Ethereum's proof-of-stake mechanism now attracts institutional capital at scale, reinforcing ETH's utility beyond speculative trading.

Ethereum Price Holds Key Support, $5,000 Target in Sight

Ethereum's price action remains pivotal as it consolidates between $4,100 and $4,800. Market analyst Daan Crypto Trades identifies $4,400 as the critical support level—coinciding with the 200-day moving average on 4-hour charts—that could determine ETH's trajectory toward $5,000.

Despite recent volatility and liquidity grabs, institutional accumulation signals underlying strength. Bitmine Immersion Technologies continues adding positions, albeit at a moderated pace, suggesting sustained buyer interest above the $4,400 threshold.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH has a strong possibility of reaching $5,000. The price is currently trading above its 20-day moving average, showing bullish momentum, while institutional adoption through Grayscale's staking plans and the upcoming Fusaka upgrade provide fundamental support.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,467.52 | Bullish |

| 20-day MA | $4,441.15 | Support Level |

| Bollinger Upper | $4,711.29 | Near-term Resistance |

| MACD | -74.30 | Watch for reversal |

The combination of technical strength and positive fundamental developments creates favorable conditions for ETH to test the $5,000 level in the coming months.